WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

When the quarantine first began, I knew that I needed to establish some habits to keep myself grounded. One of those habits was a daily gratitude practice (I use the Five Minute Journal). The journal has many daily prompts, one of which is “Daily Affirmations: I am ____________.” Recently, I looked back at my entry […]

June 9, 2020

read more

Throughout the past few months, as I think about markets and investing, I’ve had an image in my mind’s eye. It’s that of the iconic Bixby Canyon bridge in Big Sur, California . As you wind your way down the coast of California on Highway 1, this bridge spans a staggeringly deep valley that plunges […]

May 7, 2020

read more

“When will this end?” “Has the market reached its bottom yet?” “Could asset prices go higher? “Could asset prices go lower?” “What else will the government do?” “How will the virus progress from here?” These are just a sampling of the questions I’ve been discussing with clients over the past months as the COVID-19 situation […]

April 28, 2020

read more

Each quarter, we will share three things that we are keeping Top of Mind 1.Charitable Giving during COVID Many of us are searching for ways to direct our charitable dollars directly to COVID19. Schwab Charitable published an excellent resource providing valuable information on national organizations as well as tips to direct your search to your community. […]

April 27, 2020

read more

Note: Life isn’t easy at the moment for any of us. We have financial concerns, as well as very real health concerns. While this post will focus on the “investing” side of things, please don’t think for a minute that I’m blind to the seemingly more pressing concerns surrounding our health and the health of […]

March 9, 2020

read more

A fundamental part of being an investor is having a strategy for handling challenging times. It takes someone with a rationale mind, a steady hand, and an ample supply of knowledge and grit to be an investor in times of uncertainty. And once again, we find ourselves in such a time. It is never easy and it’s […]

February 26, 2020

read more

“When the facts change, I change my mind “ This well-known quote from John Maynard Keynes is a seemingly sound piece of advice. However, when it comes to your investing journey, you have to be careful about changing your mind too quickly. When major events occur and media headlines express panic and uncertainty, our instincts […]

February 6, 2020

read more

The SECURE Act (“Setting Every Community Up for Retirement Enhancement”) was signed into law in the final days of 2019. It includes significant changes to retirement savings and will affect many individuals, most notably those in or nearing retirement, new parents, small business owners and employees and could also have a major impact on estate […]

January 18, 2020

read more

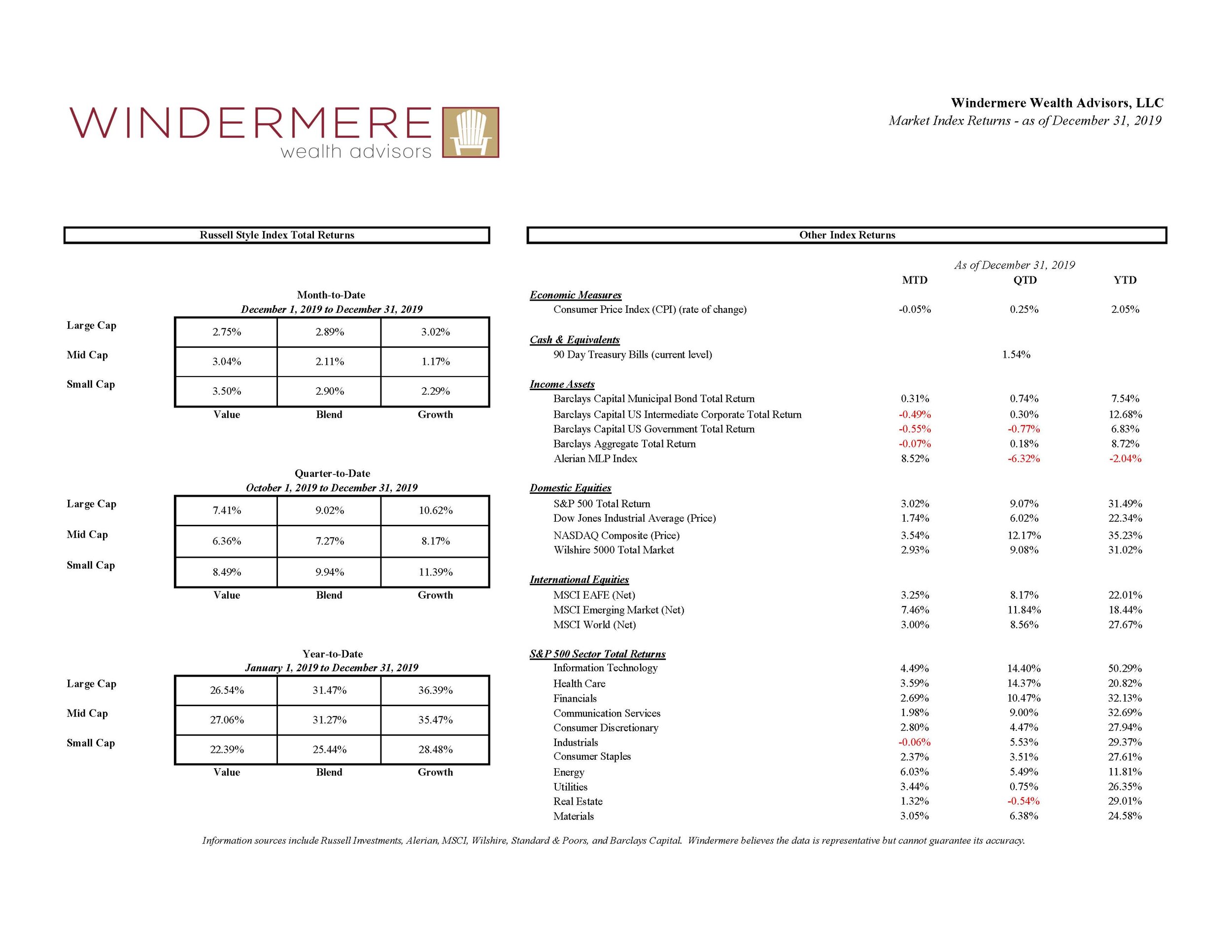

View fullsize Many investors are still flying high after a very successful 2019. Returns for virtually all asset classes were above average in the year, coming off of a challenging end to 2018. Chart shows the returns by asset class for the year (click on chart to enlarge). Below are some key items we are […]

January 18, 2020

read more

Each quarter, we will share three things that we are keeping Top of Mind Here’s our latest list: 1.) 20 for 2020 – I shared this concept with you last year as well, but I loved the concept so much I have made it an annual tradition. I was first introduced to this concept on the […]

January 18, 2020