WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

You’ll have to forgive this Canadian for the hockey analogy but it occurred to me lately that this famous quote from the “Great One” perfectly summarizes our approach to markets: I skate to where the puck is going to be, not to where it has been ~ Wayne Gretzky It’s so tempting as investors to […]

October 8, 2018

read more

“Timing is everything” This age-old saying can be applied to so many areas of our lives – including investing. Lately, it seems like timing is on top of a lot of investors’ minds. Questions such as: Is it time to get out of the market? Is it time to go all in? Is it time […]

September 5, 2018

read more

2018 sits in stark contrast to 2017 when it comes to many things – including investing and the markets. After a steady climb in 2017, where almost nothing could stop the upward movement across virtually all asset classes, 2018 has been a much more challenging investment environment. Emerging markets have faced headwinds from a rising […]

August 2, 2018

read more

Remember Tug of War? Something tells me you may have played on the playground or at a family reunion. Split into two groups (ideally of equal strength), pick up your respective ends of the same rope, and pull as hard as you can. Eventually, one group prevails – whether it be due to momentarily greater […]

July 3, 2018

read more

Summer has finally arrived. There is a seemingly endless list of things to do and places to be – leaving even less time than usual to focus on your money and the markets. What key items should you be paying attention to? We suggest keeping your “eye on the TIGER” – Trade, Interest rates, Growth, […]

June 12, 2018

read more

A few parting thoughts and some funny outtakes from the meeting Omaha is a great town. At the suggestion of my friends (who had been before), we stayed right by the arena in Old Market. Hotel rooms are at a premium but it was an excellent location and very convenient Gorat’s, one […]

May 9, 2018

read more

This was my first time attending the Berkshire annual meeting. I always thought I had a pretty good idea what the weekend entailed. But it wasn’t until I went to Omaha and lived the experience that I was able to see it for what it really is – A Master Class in community, investing, business, […]

May 9, 2018

read more

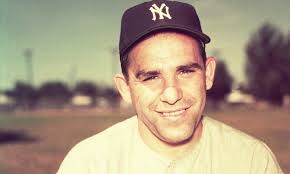

“It’s deja-vu all over again” Some of you may recognize this as a quote from the one and only Yogi Berra. Others of you may feel it should be the title slide for this year’s market. You’re both right! Watch the business news on any given day and you will likely be left with the […]

May 7, 2018

read more

What is something worth? That’s a simple question without a simple answer. You could argue that something is worth the value stated on the price tag, or the price the purchaser is willing to pay and a seller is willing to accept, or even the quantitative price plus an implied value for the associated qualitative […]

April 4, 2018

read more

Predictability and consistency. Who among us doesn’t thrive under such conditions? Most of us like things we can count on. We enjoy feeling as if we are in control of what comes next. We don’t like unexpected surprises (good or bad). 2017 was such an environment for investors. A welcome calm passage in the investing […]

March 8, 2018