WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

Each quarter, we will share three things that we are keeping Top of Mind Here’s our latest list: 1.) 20 for 2020 – I shared this concept with you last year as well, but I loved the concept so much I have made it an annual tradition. I was first introduced to this concept on the […]

January 18, 2020

read more

Rebalancing. One of many investing buzzwords that deserves a closer look. Let’s start with your target allocation. When you started investing, a target allocation was set for you and your specific situation, based upon a variety of factors including risk tolerance, liquidity needs, timeline, long-term goals, and many others. Your target allocation specified how much […]

December 6, 2019

read more

If you’re feeling a bit of motion sickness from the markets over the past eighteen months, you are not alone. Markets have been on a bit of a roller coaster – now returning to the same platform where we all got on the ride, with the market recently crossing over to all time highs. But […]

July 17, 2019

read more

There were few investors who were sorry to see 2018 go. Market movements in October thru December brought returns for the year negative and erased most annual gains, all while worrying investors with significant daily movements and seemingly endless selling pressure. Why did these sharp downward moves occur? Markets are complex and there is no […]

February 6, 2019

read more

I’m an avid reader of all things Seth Godin, including his daily blog posts. This recent post stuck a cord and made me think of recent market activity. *Be sure to visit the link to the post and consider subscribing!) The title of the post was “String too Short to be Saved”, telling the story […]

December 4, 2018

read more

Each quarter, we will share three things that we are keeping Top of Mind Here’s our latest list: 1.)Social Security – It’s an incredibly complex system that despite paying into it for our entire careers, few of us fully understand. Not to fear, we are here to help! Here are a few things to keep in […]

October 8, 2018

read more

You’ll have to forgive this Canadian for the hockey analogy but it occurred to me lately that this famous quote from the “Great One” perfectly summarizes our approach to markets: I skate to where the puck is going to be, not to where it has been ~ Wayne Gretzky It’s so tempting as investors to […]

October 8, 2018

read more

“Timing is everything” This age-old saying can be applied to so many areas of our lives – including investing. Lately, it seems like timing is on top of a lot of investors’ minds. Questions such as: Is it time to get out of the market? Is it time to go all in? Is it time […]

September 5, 2018

read more

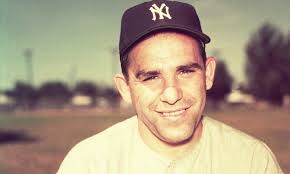

“It’s deja-vu all over again” Some of you may recognize this as a quote from the one and only Yogi Berra. Others of you may feel it should be the title slide for this year’s market. You’re both right! Watch the business news on any given day and you will likely be left with the […]

May 7, 2018

read more

What is something worth? That’s a simple question without a simple answer. You could argue that something is worth the value stated on the price tag, or the price the purchaser is willing to pay and a seller is willing to accept, or even the quantitative price plus an implied value for the associated qualitative […]