WEEKLY

WRITINGS

FINANCIAL

PLANNING

MarKETS

All

Allow our words to help guide your financial journey

Welcome to the WINDERMERE blog

read more

“Are we there yet?” When I was a kid, within about 20 minutes of any road trip, I would inevitably shout this question from the back of the station wagon. As we enter our sixth month of “life since COVID-19,” I’d venture to guess we are all asking ourselves this question in many areas of […]

September 9, 2020

read more

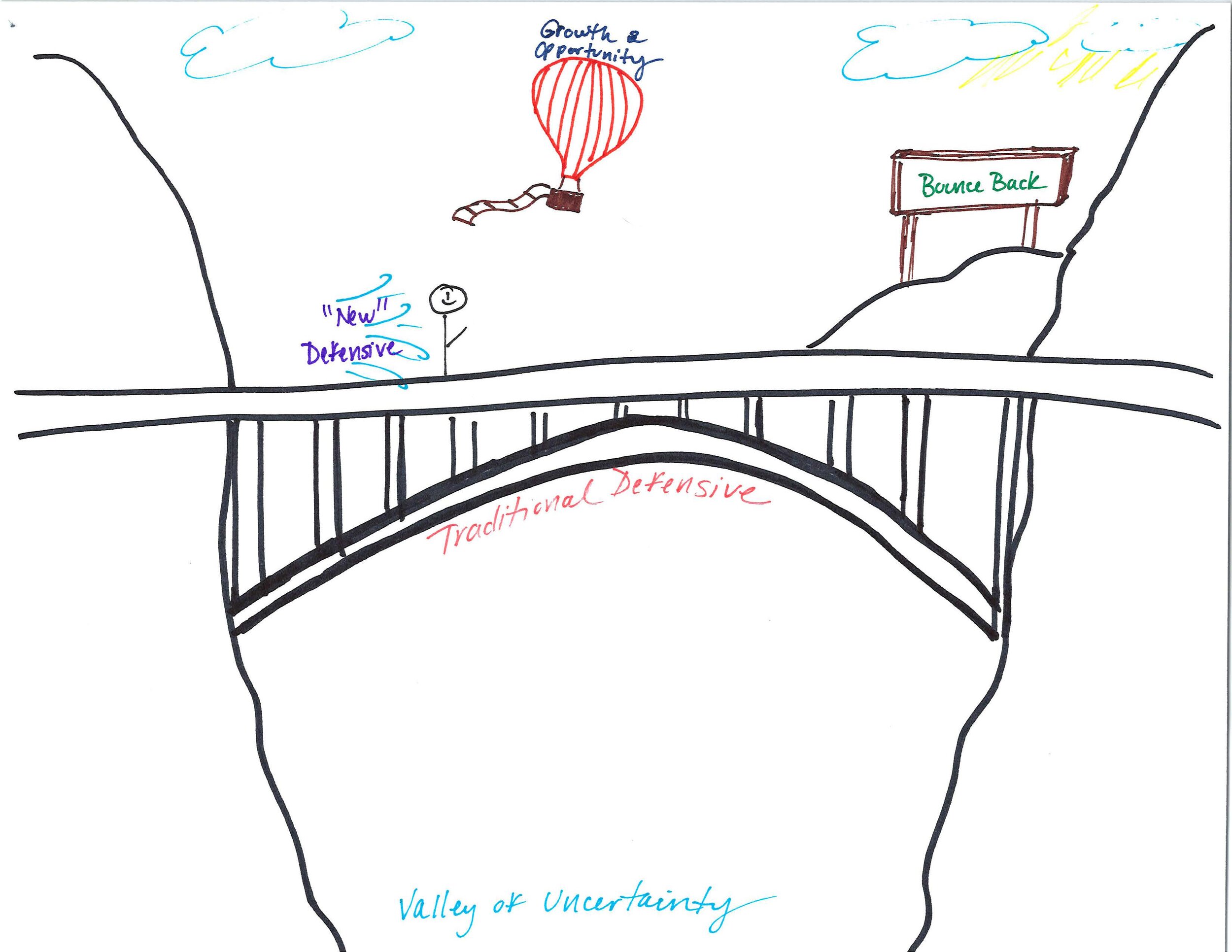

Throughout the past few months, as I think about markets and investing, I’ve had an image in my mind’s eye. It’s that of the iconic Bixby Canyon bridge in Big Sur, California . As you wind your way down the coast of California on Highway 1, this bridge spans a staggeringly deep valley that plunges […]

May 7, 2020

read more

“When the facts change, I change my mind “ This well-known quote from John Maynard Keynes is a seemingly sound piece of advice. However, when it comes to your investing journey, you have to be careful about changing your mind too quickly. When major events occur and media headlines express panic and uncertainty, our instincts […]

February 6, 2020

read more

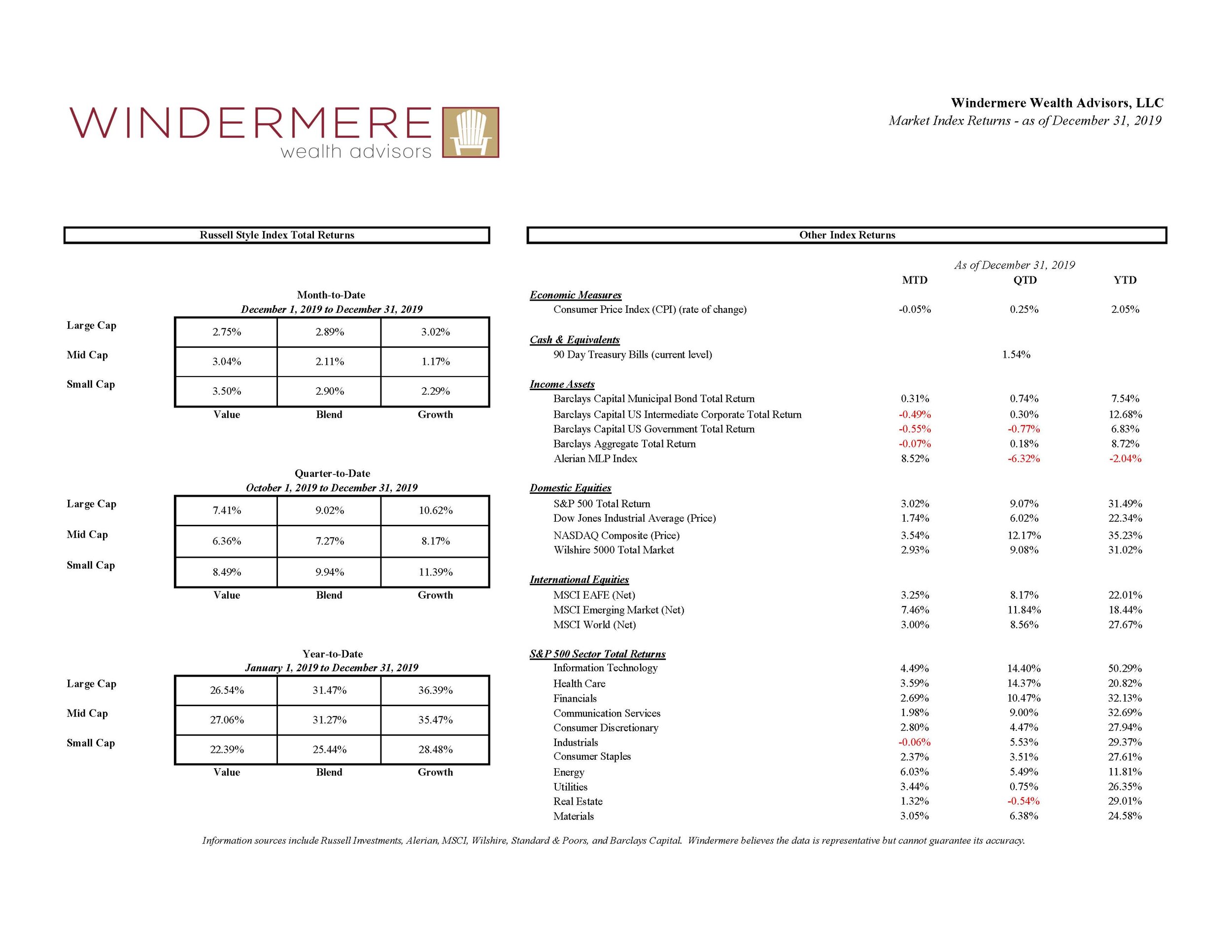

View fullsize Many investors are still flying high after a very successful 2019. Returns for virtually all asset classes were above average in the year, coming off of a challenging end to 2018. Chart shows the returns by asset class for the year (click on chart to enlarge). Below are some key items we are […]

January 18, 2020

read more

2019 has not been the easiest year to be an investor. It seems we take a few steps forward, only to be forced to then take a step back. The year starts strong, only to pull back a bit in recent months. The consumer continues to show great signs of strength, only to be dampened […]

October 8, 2019

read more

Turn on the TV, pick up your phone, or read most major newspapers as of late and you are likely to walk away with a rather unsettling feeling about investing. There is a seemingly omnipresent supply of confusing terminology (ie: yield curve inversion, recession, tariffs, trade war) and an equal supply of doomsday predictions. All […]

September 5, 2019

read more

What is happening? August is traditionally a slow month – as we ease from summer fun back into the routineness of fall. Not this year, at least as it relates to the markets. In case you’ve tuned out business news for the past week, here is what you’ve missed: *What goes up is coming back […]

August 6, 2019

read more

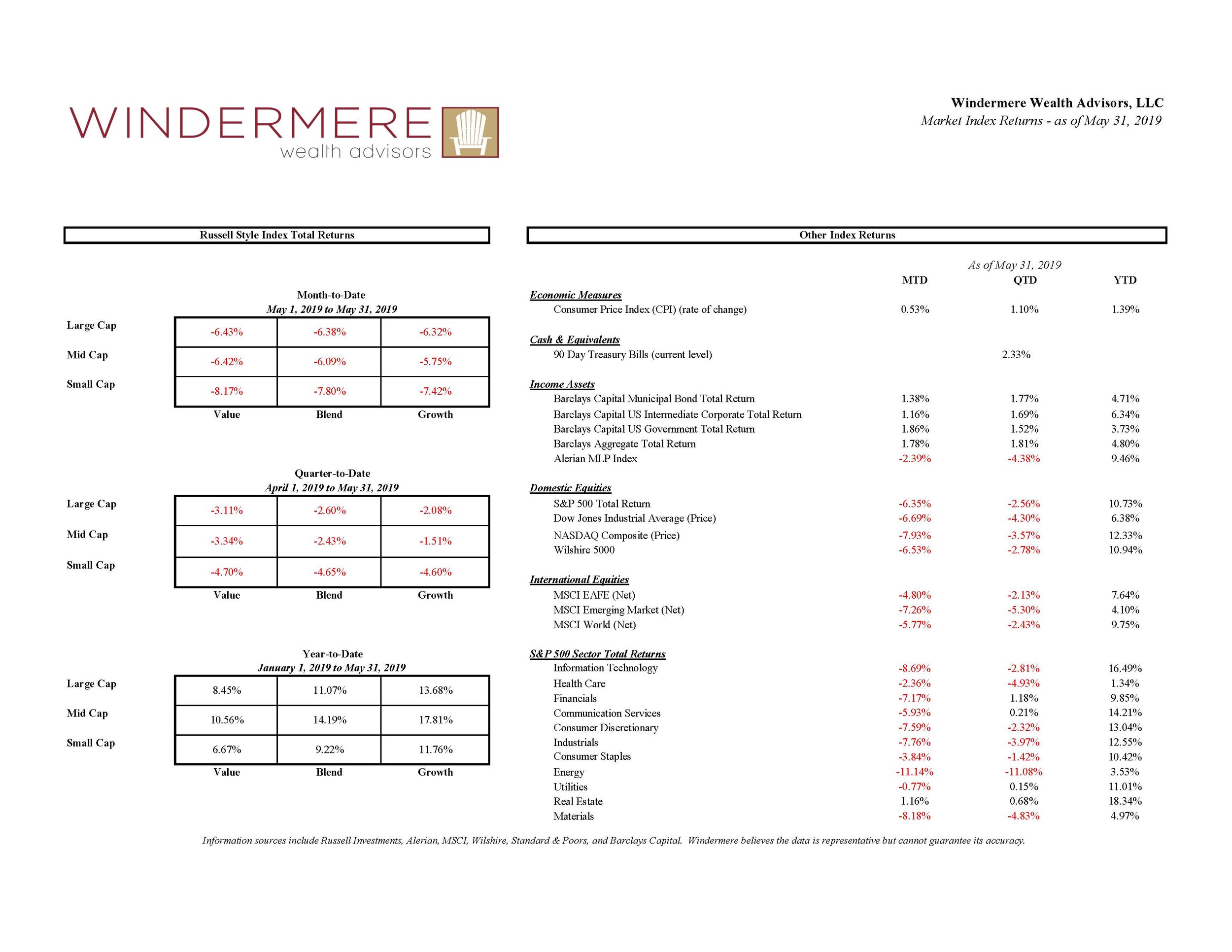

During the first four months of 2019, it seemed as if nothing could get in the way of markets. While uncertainty remained (tariffs, interest rates, economic strength, recession worries), markets ticked higher seemingly every day. In early May, that all changed. See below for market returns during May 2019 View fullsize While it’s hard to […]

June 9, 2019

read more

I recently attended Schwab’s IMPACT conference in Washington DC. IMPACT is a conference for independent advisors that custody assets at Schwab (like Windermere). The three day agenda is filled with education sessions on the markets, economy, and our practices as well as high profile keynote addresses and opportunities to connect with money managers, Schwab personnel, […]

November 5, 2018

read more

Summer has finally arrived. There is a seemingly endless list of things to do and places to be – leaving even less time than usual to focus on your money and the markets. What key items should you be paying attention to? We suggest keeping your “eye on the TIGER” – Trade, Interest rates, Growth, […]

June 12, 2018